In the face of growing regulatory requirements and investor expectations, ESG reporting has become one of the major challenges for modern businesses. Companies must be prepared to systematically report on their environmental, social and governance impacts. Although the ESG reporting obligation has been postponed in Poland, it is worth starting preparations for the upcoming changes now. It is important not only to understand regulatory requirements but also to implement appropriate technological tools that will enable the effective collection, processing and reporting of ESG data. This article aims to explain what ESG is, who is subject to reporting obligations, and how Microsoft Dynamics 365 Business Central supports organizations in the collection and reporting processes.

What is ESG reporting?

ESG stands for: Environment, Social and Governance. It is a standardized way of measuring and reporting a company’s impact on the environment as well as the influence of environmental, social and governance factors on the business.

Unlike previous CSR reports, ESG is based on specific, measurable indicators regulated by European Sustainability Reporting Standards (ESRS). Businesses are required to systematically collect and report hundreds of data points – from CO2 emission and board diversity to risk management systems. ESG complements financial reporting, providing investors and stakeholders with a comprehensive picture of a company’s long-term sustainability and accountability.

Why is ESG more than just an obligation?

Investors and banks are considering environmental and social factors in their financial decisions more and more often. Companies that can present their responsible practices in a transparent way gain access to better financing conditions and greater market interest. Perceiving ESG not as a burden but as an opportunity to strengthen the company’s market position is crucial.

What does ESG reporting cover?

ESG reporting covers a broad range of indicators divided into three main pillars. Pillar E (Environmental) describes the company’s impact on the natural environment. The most important indicators in this area include greenhouse gas emissions, categorized as follows:

- Scope 1 (direct) – emissions that a company generates directly from sources it owns or controls. An example from furniture manufacturing: Exhaust gases from forklifts on factory premises, emissions from the boiler room heating the production halls.

- Scope 2 (indirect) – emissions associated with the electricity, heat or steam that the company purchases and consumes. Although these emissions are physically generated outside the company (e.g. in a power plant that supplies energy), they are a direct result of the company’s activities and must be included in the report. An example from furniture manufacturing: electricity used to power saws, grinders and other woodworking machines – emissions are generated in the power plant but result from factory operations.

- Scope 3 (indirect – supply chain) – all other emissions across the supply chain over which the company has no direct control. These are the most difficult to measure. An example from furniture manufacturing: Cutting down trees in forests, transporting timber by trucks to the factory.

This also includes water consumption, waste management, air, soil and water pollution, as well as the impact on biodiversity and ecosystems.

Pillar S (Social) focuses on the social responsibility of the company. It includes key areas such as working conditions and employee safety, diversity and gender equality in management, training and professional development programs, and relations with local communities. Respect for human rights throughout the supply chain and ethical treatment of all company stakeholders are equally important.

The final Pillar G (Governance) describes how the company is managed and how decisions are made. It covers the independence of the supervisory board, risk management, business ethics and reporting transparency.

Double Materiality

The new CSRD directive introduces an important principle – double materiality. This means that companies must demonstrate two aspects:

- Impact Materiality: How the company’s activities affect the environment and society.

- Financial Materiality: How ESG issues affect the company’s financial performance (e.g. risks related to access to raw materials, reputation or climate change, which may lead into asset impairment or increased costs).

This approach makes the ESG reporting an integral part of strategic and risk management. Companies must not only demonstrate how responsible they are but also show how their sustainability strategy translates into tangible business benefits.

The scope of ESG reporting is regulated by detailed ESRS standards introduced under the CSRD directive. These include hundreds of environmental, social and governance indicators that companies must systematically monitor and report.

Who is subject to ESG reporting?

ESG obligations come into force gradually – depending on the size of the company, number of employees, turnover, and balance sheet total. The Polish government has extended the timeline for implementing the CSRD directive, giving companies more time to prepare.

Current timeline:

| Entity group | Criteria | Reporting obligation for the fiscal year | Report publication date |

| Phase I | Large public-interest entities (PIEs) that are already subject to the Non-Financial Reporting Directive (NFRD). Criteria: >500 employees and balance sheet total >EUR 25 million or net revenues > EUR 50 million. | 2024 | 2025 |

| Phase II | Large enterprises not previously subject to reporting, meeting two of the following three criteria: >250 employees, a balance sheet total >EUR 25 million or net revenues >EUR 50 million. | 2027 | 2028 |

| Phase III | Small and medium-sized enterprises (SMEs) listed on regulated markets in the EU (excluding micro-enterprises). | 2028 | 2029 |

The domino effect – why it affects every business

Even if the company is not directly subject to ESG obligations, it will likely still need to provide data to its customers. Large companies reporting Scope 3 emissions will require suppliers to provide detailed information on their carbon footprint. A practical example: A company that supplies components to a major automotive manufacturer that must submit their ESG report in 2026 will likely receive a questionnaire regarding its CO2 emissions.

The postponement of reporting deadlines in Poland presents an opportunity. The additional time allows companies to implement IT systems, train employees and test processes. Data collection also helps companies to avoid the costly reconstruction of historical data – recreating last year’s emissions based on invoices and documents is much more difficult than collecting them on an ongoing basis.

The role of ERP systems in ESG transformation

The biggest challenge in ESG reporting is that the required data is dispersed across different locations. Information on energy consumption may be stored in the technical system, transport data – in logistics systems, employee data – in HR, and emissions from production – in yet another system. Manual collection, aggregation and verification of this data are time-consuming, costly and prone to errors.

How does Business Central solve this problem?

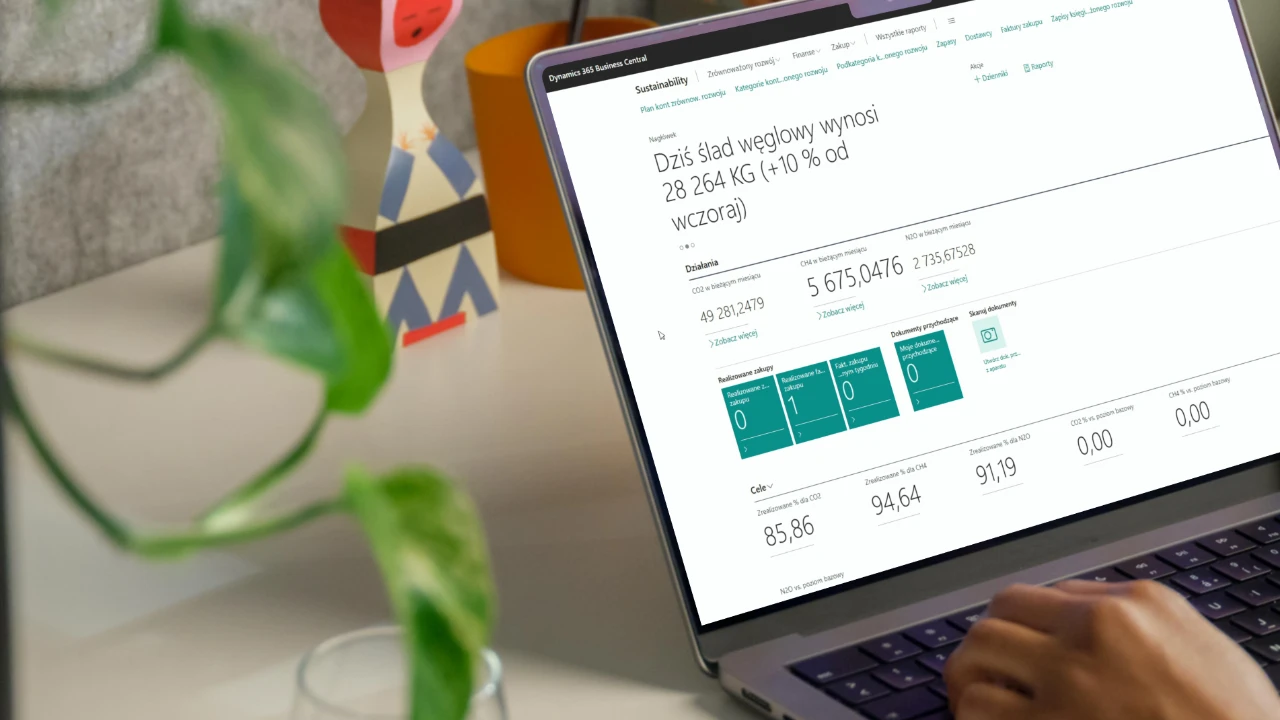

ERP systems such as Microsoft Dynamics 365 Business Central are becoming key tools for automating the entire ESG reporting process. The system provides a single, reliable source for all data – both financial and ESG. Instead of searching for information across multiple systems, users can access everything from one place. Moreover, modern ERP systems can automatically collect data from operational processes – from energy consumption by production machines and waste volumes to emissions from company vehicles.

Key ESG features in Business Central

Microsoft Dynamics 365 Business Central offers dedicated functionalities that support ESG reporting:

- Sustainability Journal: A dedicated place to record all ESG data, both numerical and qualitative.

- Chart of Sustainability Accounts: an accounting framework that allows categorization and tracking of emissions and other ESG indicators.

- Support for 1, 2 and 3 emissions: the system enables data to be categorized in accordance with standards, which is essential for accurate reporting.

- Automatic emission calculation: emission factors convert quantitative measures (kilometers, liters of fuel, kWh) into CO2 values.

- Reports and data visualization: pre-built templates and charts to facilitate data analysis and presentation, enabling quick analysis in Excel spreadsheets, tables and charts.

ESG implementation provides an excellent opportunity to modernize a company’s IT architecture. Process automation not only simplifies reporting but also increases operational efficiency and reduces costs.

Business Central enables companies to move from manual, error-prone processes to automated ESG data management. This is an investment that delivers benefits that go far beyond the reporting obligation itself.